Renters Insurance in and around Nampa

Renters of Nampa, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through deductibles and coverage options on top of family events, your pickleball league and managing your side business, can be time consuming. But your belongings in your rented space may need the impressive coverage that State Farm provides. So when the unexpected happens, your sound equipment, appliances and furniture have protection.

Renters of Nampa, State Farm can cover you

Renters insurance can help protect your belongings

Why Renters In Nampa Choose State Farm

You may be wondering if Renters insurance can help you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the condo. What would happen if you had to replace your belongings can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

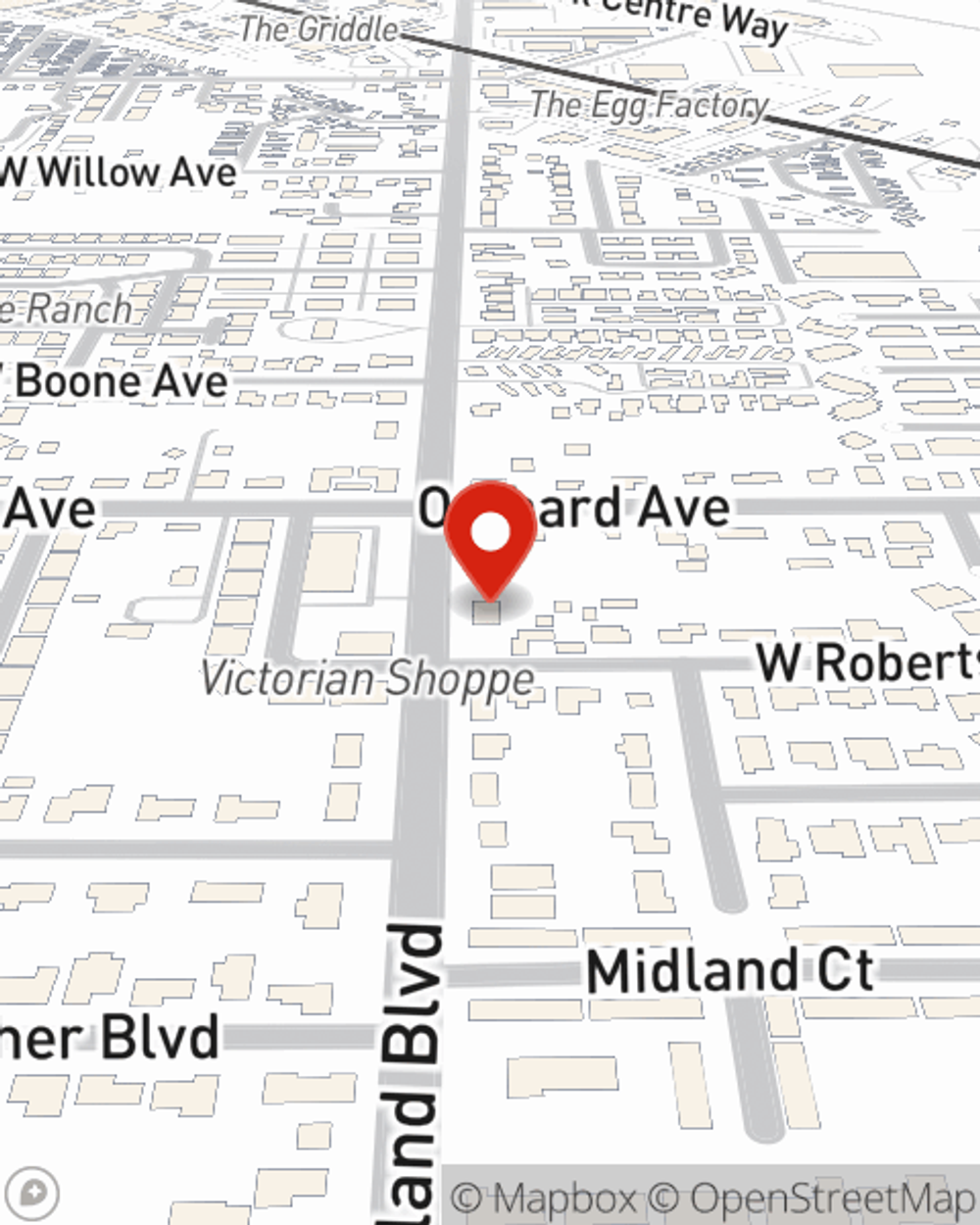

State Farm is a committed provider of renters insurance in your neighborhood, Nampa. Call or email agent Ken Wells today to learn more about coverage and savings!

Have More Questions About Renters Insurance?

Call Ken at (208) 466-4162 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.